Our Experience Is Your Advantage.

Our expertise lies in creating risk-resiliency for Catholic dioceses.

Our Catholic Dioceses Practice

Our footprint and reputation in helping Catholic dioceses across the country establish risk-resilience is second to none. We have a deep understanding of the many risks faced by religious institutions and how best to put together a program that will respond to these risks.

We also have a passion for helping those who are helping others. It’s personal for us and one of the hallmarks of our business. Over the years we have provided dioceses with self-insurance and captive alternatives supported by a risk-management approach that has garnered favorable results in protecting an organization and reducing the total cost of risk.

We Look at Risk from Every Angle

A Catholic diocese provides a myriad of services – from operating schools to transporting children, offering volunteer and counseling support services to the community; providing housing; holding fundraisers and other events; and much more. With these services come challenges and a broad range of exposures. Add to this budgetary concerns that differ from for-profit organizations. At Porter & Curtis, we understand each diocese’s mission and the risks involved along with the budgetary constraints and create innovative solutions that help our clients manage their risks.

Integrated Risk Management

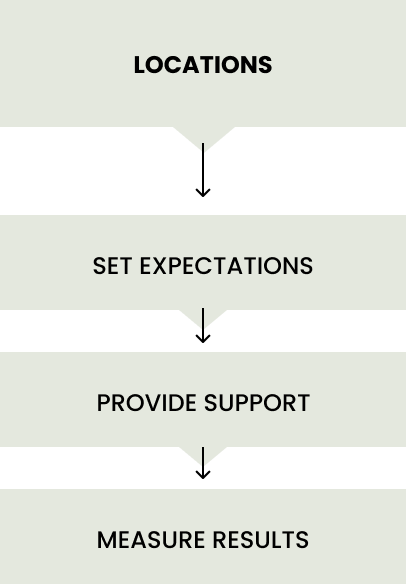

Our Integrated Risk Management© approach identifies the root causes of loss to determine what changes in the organization and/or processes could be made to get positive outcomes and

reduce claims. We look at existing standards being employed throughout the organization such as tenant and vendor contracts; hazard identification processes; motor vehicle usage; cybersecurity training; concussion protocols; HR practices including employment practices and OSHA training; and insurance and how it is being administered, among others.

We then create practical, manageable risk-management standards based on the loss drivers in the organization. We also provide a diocese with support to help it meet those standards, and measure results. Our clients also have access to a customized risk management software application, Quadra, to maintain insurance exposure asset information, allocate insurance costs, and manage risk and loss control through a streamlined, easy-to-use interface.